ReSt@rts links demand and supply of financial and non-financial services, to support Mediterranean youth entrepreneurs

ReSt@rts “Reinforcing Med Microfinance Network System for Start-ups” project's main scope is to support broadening the available financial options available, by improving understanding about the full range of financing instruments, by encouraging discussion among stakeholders about new approaches and innovative policies for SMEs and entrepreneurship financing.

ReSt@rts will promote Microfinancing and propose alternative financing tools such as Crowdfunding. Therefore, it aims to contribute to the sustainability of new start-ups in the Med area by researching the Microfinance Industry, disseminating the respective knowledge, and proposing policies to interested stakeholders.

SAFE (Survey on the Access to Finance of Enterprises) Report of 2021, implemented by the European Central Bank for the European Commission, clearly shows that at Greece level, Business loans to SMEs are difficult to be approved by Banks.

Specifically, 49% of Greek SMEs submit loan requests and 21% of them are rejected. The 51% of SMEs that does not submit loan requests is due to high lending rates, insufficient collaterals, bureaucracy in issuing supporting documents, banks fear for more “red loans” and other reasons.

This means that out of 100 SMEs in Greece, 51 are reluctant to apply for a loan and approximately 11 of those that submit a loan request gets rejected. Overall, 62 SMEs out of 100 are not willing or cannot access the Greek Bank loan system.

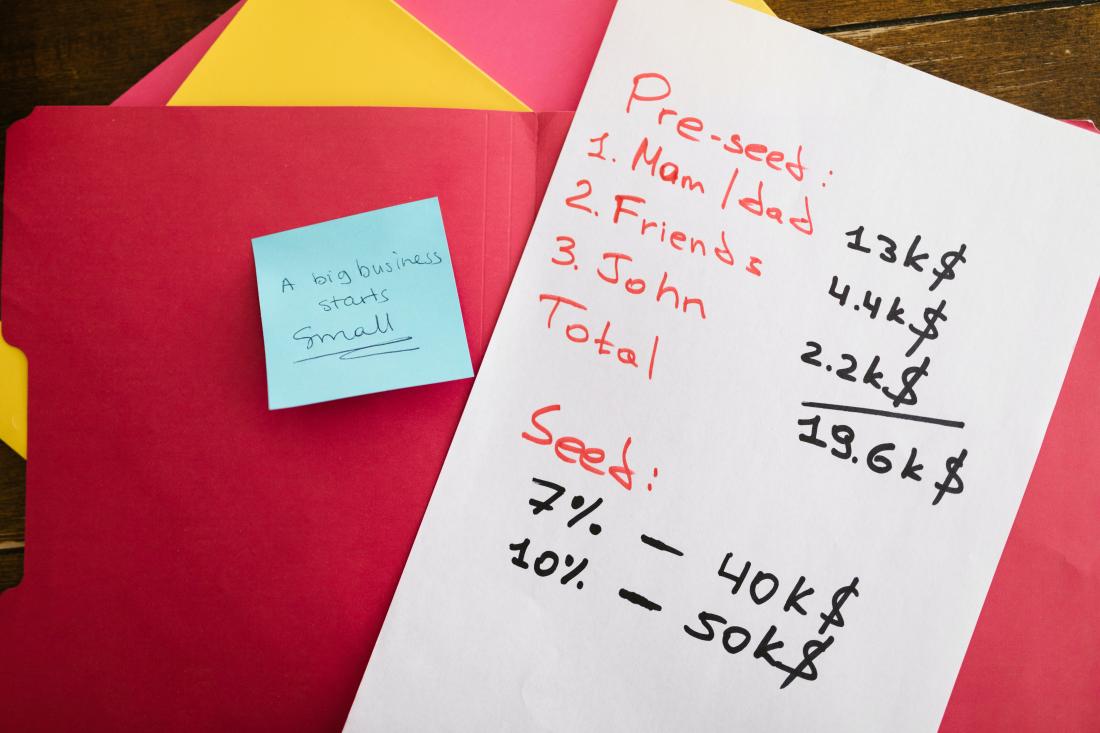

The situation for new micro-SMEs probably is much worse since they fall short of all the criteria banks set to determine loan eligibility, such as revenues, credit history, proof of business longevity etc. Therefore, it is very difficult for them to jumpstart their economic viability.

Micro-SMEs (MSMEs) need to seek other sources for securing credit.

MicroFinance in Greece

MicroFinance was introduced in Greece through the EU Microfinancing Mechanism “Progress” that guaranteed Micro-Finance Institutions (MFIs) for their loans to Beneficiaries and financed the increase of micro-loans amounts up to 25.000€ with no collateral. However, with limited information on how to apply the specifications regarding the “Progress” Tool, the Microfinance Market in Greece was rather “small”.

A new law was applied in July 2020 to regulate MFIs and Beneficiaries in Greece. This is the first indication that the Greek state starts being serious about Microfinancing. Stakeholders are positive about the new legislation. The obvious benefits for the Greek market are expected to be closing the loan gap, establishing a licensed MFI becomes an investment opportunity, increased number of licensed MFIs equals to increased micro-loans availability MBs, which in turn become self-sustainable faster.

Crowdfunding in European Level

Since November 2021 Crowdfunding must be implemented under Regulation (EC) 2020/1503 so that all EU countries will have a common operational framework. The new Regulation promotes cross-border Crowdfunding services, establishing uniform requirements for the provision of such services, the licensing and supervision of providers of such services, and the operation of the respective platforms.

According to Cambridge Centre for Alternative Finance (CCAF), which performs an annual online alternative financing survey, the estimated number of crowdfunding platforms in Europe back in 2018 was 632. These platforms contributed with a total volume of EUR 6.5 billion in financing.

The total volume of the crowdfunding market in Europe has significantly increased in recent years, showing the need and use of crowdfunding in Europe as an alternative source of finance.

ReSt@rts project, as capitalization of the MEDST@rts project, both funded by the ENI CBC MED Programme, has as main aim to reinforce the Med Microfinance network system for start-ups by promoting economic and social development and supporting innovative start-ups and recently established MSMEs. Bringing together MSMEs and bodies offering services to such businesses, from different countries and financing cultures, will upgrade readiness level on Microfinancing and give an added value to the specific financing sector.